(Disponible en français)

Table of Contents

You can use this application to apply to the Landlord and Tenant Board (LTB) for an order allowing a rent increase of more than the guideline for one or more rental units in the residential complex. An Above-Guideline Increase (AGI) application can be made for one or more of the following reasons:

You cannot apply for a rent increase above the guideline for a rental unit if the tenancy agreement of a new tenant took effect after you completed the work related to the capital expenditure.

Important: You must file Form L5 no later than 90 days before the First Effective Date (FED) of the intended rent increase identified in your application (for more information about the FED, refer to Section B, Part 1 of these instructions).

Read these instructions before completing the application form. You are responsible for ensuring that your application is correct and complete.

The LTB offers services in both English and French. If you, your representative, or one of your witnesses would like to receive French Language Services, please select French.

The LTB is committed to treating all persons with dignity and respect and in a manner that promotes independence. The LTB is committed to providing an inclusive and accessible environment in which all persons have equitable access to our services.

Accommodations are arrangements to allow everyone, regardless of their abilities, to participate fully in the LTB's process.

Complete the Accommodation Request form if you require accommodation under the Ontario Human Rights Code or for a procedural fairness need. Provide as much detail as you can about your request for accommodation for your upcoming hearing. Email or mail your completed form to the LTB office that is handling your file. The LTB will review your request and make a decision based on the information you provide.

The form and more information about accommodation is available at tribunalsontario.ca/en/supports-and-services/request-an-accommodation/.

The LTB will not include a copy of this form when we give the other parties a copy of the application form. However, the information will be included in your application file. The file may be viewed by other parties to the application.

Fill in the complete address of the residential complex and the postal code. If your application involves more than one unit, do not include the unit numbers. If your application involves only one unit, include the unit number.

If your application involves a residential complex with multiple addresses, complete the Additional Residential Addresses form and file it with the application. You must include the full address and postal code for each unique address.

If the street name includes a direction that will not fit in the space provided (such as Northeast) use the following abbreviations: NE for Northeast, NW for Northwest, SE for Southeast, SW for Southwest.

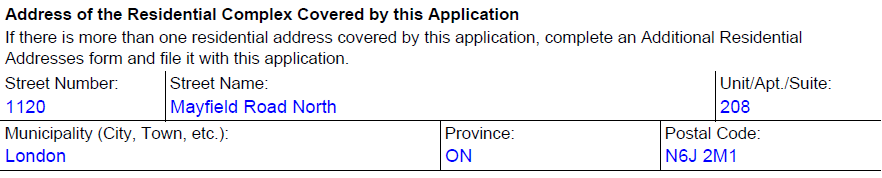

Example:

If the address is: 1120 Mayfield Road North, London, this is how you should complete Part 1 of the application:

You must complete the L5 – Rental Unit Information (RUI) form and submit it electronically in MS Excel format. This form requires you to provide the Tenant mailing address(es) and rental unit information.

Refer to Section C: L5 – Rental Unit Information (RUI) form, for more information on how to complete this form.

You must enter the date of the first rent increase you intend to take in DD/MM/YYYY format. If your application is granted, any above guideline increase ordered will be retroactive to the FED.

The FED determines the following:

If a previous order was issued under the Residential Tenancies Act, 2006 (RTA) increasing the rent above the guideline for the same residential complex, then fill in the file number of that order. If there has been more than one previous order, fill in the file number for the most recent order.

In the Landlord's Name and Address section, fill in the landlord's name and address. If the landlord is a company, fill in the name of the company under "Company Name". Include a telephone number and an e-mail address, if you have them. The Board will communicate with you by e-mail, if an e-mail address is provided.

If there is more than one landlord, fill in information about one of the landlords in this section of Part 1. Provide the names, addresses and telephone numbers of the additional landlords on the Schedule of Parties Form which is available from the LTB website at tribunalsontario.ca/ltb.

Shade the appropriate box or boxes to indicate the reason(s) on which you are basing your application.

Reason 1: The municipal taxes and charges for the residential complex increased by an "extraordinary" amount.

Shade this box if there has been an extraordinary increase in the cost of municipal taxes and charges for the complex in the previous calendar year. Municipal taxes and charges include taxes charged to a landlord by a municipality, charges levied on a landlord by a municipality, taxes levied on a landlord's property in unorganized territory and education taxes.

An increase in the cost of municipal taxes and charges is extraordinary if it is greater than the annual rent increase guideline plus 50% of the guideline. Use the guideline in effect for the year of the FED.

Example: If the guideline is 0.8%, then the guideline plus 50% of the guideline is 0.8% + 0.4% = 1.2%. If the landlord's taxes have gone up by more than 1.2%, then this increase is "extraordinary".

If you are applying for this reason, complete Schedule 1: Details of Operating Costs (A, C, D and E).

Reason 2: Operating costs for security services for the residential complex have been experienced for the first time or have increased.

Shade this box if you are providing security services to the complex for the first time, or if your operating costs for security services have increased. Security services must be provided by persons who are not your employees.

If you are applying for this reason complete Schedule 1: Details of Operating Costs (B, C, D and E).

Reason 3: Capital expenditure work was done in the residential complex.

Shade this box if you are applying because you have done capital expenditure work.

A capital expenditure is an expense for significant renovation, repair, replacement or new addition. The expected benefit of a capital expenditure must be at least five years. Expenditures for routine maintenance or work that is substantially cosmetic in nature are not considered to be capital expenditures and cannot be claimed in the application. Eligible capital expenditures can include work to protect or restore the physical integrity of the residential complex, to maintain it, to provide access for persons with disabilities, or to promote energy or water conservation. For more information refer to section 126 of the Residential Tenancies Act, 2006 (RTA) and Part III of Regulation 516/06 under the RTA (O.Reg. 516/06).

You cannot use this application if your claim is based on capital expenditure(s) to replace a system or thing that did not require major repair or replacement, unless it promotes access for persons with disabilities, energy or water conservation, or security of the residential complex or part of it.

The capital expenditure work must have been completely paid for when you file the application. The work must also have been completed within the 18 month period that ends 90 days before the FED.

If you are applying for this reason, complete Schedule 2: Details of Capital Expenditures and Capital Expenditures: Additional Details for each capital expenditure item you are claiming.

Fill in the number of residential units in the complex and the number of residential units covered by the application. Indicate units as covered by the application if you are requesting an above guideline increase for that unit. The number of units identified in this section must match the corresponding number of units in the Summary Tab of the L5 - Rental Unit Information (RUI) form. If the number of units indicated on the application does not match the RUI, the LTB will use the data outlined in the RUI form.

Indicate if there are one or more elevators in your residential complex. If yes, complete the remaining questions:

You must also indicate whether any elevator work ordered has been completed.

If you have been ordered to do elevator work and it has not been completed by the time you file the application, you must complete Schedule 3: Summary of Outstanding Elevator Work and file it with your application. A copy of this form is included at the end of the Form L5 application.

If you are the landlord, shade the box marked "Landlord". Then, sign the application form and fill in the date.

If you are the landlord's legal representative, shade the box marked "Legal Representative". Then, sign the application form and fill in the date.

Complete this section only if you are a legal representative. Fill in your name, address and contact information in the spaces provided.

You must fill out this Schedule if you are applying for a rent increase above the guideline because of increased costs for:

You must attach evidence of costs and payment for all the expenses you are applying for. As well, if you are applying because of an extraordinary increase in costs for municipal taxes and charges and you received any grants or other forms of financial assistance, rebates and/or refunds that effectively reduced the operating costs you are claiming, you must attach evidence of the amount(s) you received. Evidence could include invoices, receipts, cancelled cheques or a letter from the supplier confirming the costs and that payment was received or indicating the amount of any rebate given.

The accounting periods for municipal taxes and charges consist of a reference year and a base year. To determine the base year, calculate the date that is 90 days before the FED. This date represents the deadline to file your application. The base year is the calendar year that precedes the year of your deadline to file the application. The reference year is the calendar year immediately before the base year.

For example, if the FED for the units covered by the application is January 1, 2024, then the deadline to file the application is October 3, 2023. Therefore, the base year is 2022 and the reference year is 2021.

On the form, fill in the accounting periods and costs you experienced during each period.

In order to allocate the costs to the units affected by the increase for municipal taxes and charges and covered by the application, the LTB needs to know whether municipal taxes and charges affect all the units in the complex.

Shade either the "Yes" or "No" box to indicate whether you received any refunds, rebates, grants or other types of financial assistance for municipal taxes and charges that affect the costs for the base year and/or the reference year.

The accounting periods for security services are made up of a reference year and a base year. The base year is your most recent 12 month accounting period completed at least 90 days before the FED. The reference year is the 12-month accounting period immediately before the base year. The accounting periods for security services can be different from those for municipal taxes and charges.

If a previous order has been issued by the LTB for this residential complex allowing you to increase the rent above the guideline, the accounting periods for this application must start and end on the same days as those chosen for the previous order.

Fill in the accounting periods and the costs you experienced during each period.

After you have determined the accounting periods, fill in your costs for each period for security services.

In order to properly allocate the costs to the units affected and covered by the application, the LTB needs to know if the costs affect all the units in the complex.

Shade either the "Yes" or "No" box to indicate whether any of the operating cost categories relate to non-residential portions of the complex or other residential complexes.

If you answered "Yes", you must list the cost category and provide details about how you propose the costs should be allocated. You can propose to allocate the costs based on floor area, market value, or revenue generated. If none of these methods are reasonable, you may propose another method. You can propose different methods for allocating the costs for different operating cost categories.

For the proposed method, you must provide the information necessary to allocate the costs between the residential portions and non-residential portions of the complex (or other residential complexes). For example, if you propose that costs should be allocated based on revenue generated and the operating cost category relates to non-residential portions of the complex, you must determine the revenue generated by the residential portions and non-residential portions of the complex and provide the details in the space provided.

Shade either the "Yes" or "No" box to indicate whether the units covered by the municipal tax and/or security service reasons are different from the units listed as covered by the application on the RUI form.

If you select "No" this will indicate that the units listed as covered by the application on the RUI are covered by all of the reasons you have claimed in your application (i.e. municipal taxes and charges, security services, and/or capital expenditures).

If you select "Yes", specify which units differ from the RUI in terms of coverage for municipal taxes (Reason #1) and/or security services (Reason #2).

Here is a step-by-step guide to help you:

For example, If a mobile home (unit #3) is taxed individually and did not experience an extraordinary increase in municipal taxes, the Landlord would not be eligible to apply for an AGI against this unit due to an increase in municipal taxes. However, if the application also involves a capital expenditure which does affect unit #3, then the Landlord would indicate unit #3 as being covered by the application on the RUI. The Landlord would then select 'Yes' in Schedule 1: Part D and list unit #3 as not covered (No) by the municipal tax claim.

| Unit/Apartment/Suite | Unit Covered by Reason #1: Municipal Taxes (Yes/No) | Unit Covered by Reason #2: Security Services (Yes/No) |

|---|---|---|

| Unit 3 | No | |

In Column 1, provide the total current rent charged for all of the units listed as covered by the application for Reason #1 or Reason #2. In Column 2, provide the total current rent charged for all the units in the residential complex that are affected by Reason #1 or Reason #2. This can include units listed as not covered by the application.

If a unit in the complex that is affected by the cost category is currently vacant or not rented, use the average rent for all the rental units in the residential complex to determine the rent charged for the vacant unit.

Example:

A landlord wants to increase the rent by more than the guideline for four rental units (units 1, 2, 3 and 4) in a residential complex that has a total of six rental units. Unit 5, which is not covered by the application, is vacant. Unit 6 is rented but is not covered by the application. The landlord claims that municipal taxes and charges have increased by an "extraordinary" amount. The monthly rents for the units in the complex are as follows:

| Unit 1: $900 | Unit 2: $700 | Unit 3: $800 |

| Unit 4: $800 | Unit 5: $0 | Unit 6: $900 |

The landlord calculates the average rent for the units in the complex as follows: ($900 + $700 + $800 + $800 + $900) ÷ 5 = $820 - this is the amount the Landlord lists as the rent for unit 5 in the calculations below.

The landlord calculates the total rent charged for the units that are covered by the application as follows:

$900 (unit 1) + $700 (unit 2) + $800 (unit 3) + $800 (unit 4) = $3200

The landlord calculates the total rent charged for all the units in the complex that are affected by the costs for municipal taxes and charges as follows:

$900 (unit 1) + $700 (unit 2) + $800 (unit 3) + $800 (unit 4) + $820 (unit 5) + $900 (unit 6) = $4920

The landlord therefore completes the Table as follows:

| Operating Cost Categories | Column 1 Total monthly rent charged for rental units covered by the operating costs (municipal taxes and charges and/or security services). |

Column 2 Total monthly rent: total rent charged for all rental units in the complex affected by the operating cost |

|---|---|---|

| Municipal taxes and charges (Reason #1) | $3,200.00/per month | $4,920.00/per month |

| Security services (Reason #2) |

If you are applying for Reason 3, you must fill out this schedule.

If you are applying for a rent increase above the guideline because you incurred capital expenditures, you must fill out this Schedule completely.

You must provide evidence of costs and payment for all of the captial expenditures that you are applying for. Evidence of costs and payment could include invoices, receipts, cancelled cheques or a letter from the contractor or supplier confirming the costs and that payment was received. You must also complete a "Capital Expenditures: Additional Details" form for each capital expenditure item you are claiming.

Complete the Description and Costs table as follows:

Item #: Assign an item number to each capital expenditure item that you are claiming.

Description of Capital Expenditures: Provide a description of the work completed.

Date Completed: Fill in the date that full payment was made for the completed work.

Useful Life: Fill in the "useful life" for each capital expenditure item that you are claiming.

The useful life is the estimated number of years that the capital expenditure is expected to last or benefit the complex. A list of capital expenditure items and the useful life for each item is set out in a Schedule attached to O.Reg. 516/06.

If the capital expenditure item that you are claiming was previously used, then consider the length of time it was used for when you determine the useful life for the item.

For example, according to the Schedule, the useful life of a refrigerator is 15 years. If you purchased a refrigerator that had been previously used for 2 years then the useful life for the refrigerator is 13 years.

If the capital expenditure item is not listed in the Schedule, then select the useful life of an item listed in the Schedule that has similar characteristics. If there are no similar items listed, then you should include the number of years that is generally accepted as the useful life for the item you are claiming. However, at a hearing the LTB may find that a different useful life is more appropriate.

Note: If the useful life in the Schedule is less than 10 years, O.Reg. 516/06 states that the useful life will be deemed to be 10 years. The LTB cannot consider a useful life that is less than 10 years.

Labour/Material and Contract Costs: Fill in the labour/material and contract costs. This figure should match the total you are claiming for the capital expenditure on the Capital Expenditures: Additional Details form. You must also include invoices for these costs.

Landlord's Own Labour Hours x Rate = Total: Enter the value of the landlord's own labour. When determining the value of the landlord's own labour, you must provide information on the number of hours spent doing the work, the hourly rate and the total value claimed.

The hourly rate you are claiming must be reasonable based on your experience and skill in the type of work that was done. Calculate the total value by multiplying the number of hours you spent by the hourly rate. Do not include any amount of time you spent on the management and administration of the capital work.

Total Costs: Fill in the total costs. The total cost of each item is the sum of the labour/material and contract costs and the value of the landlord's own labour.

Note: If you want to claim a leased asset as a capital expenditure item, provide a copy of the lease. The cost you may claim is the market value of the item at the start of the lease. Fill in the market value under the column for the labour/material and contract costs of the capital expenditure item.

For each capital expenditure item included in section A of the form, explain why you believe the capital expenditure is "eligible".

A capital expenditure may be eligible under subsection 126(7) of the RTA if:

According to subsection 18(1) of 0. Reg. 516/06, "physical integrity" means the integrity of all parts of a structure, including the foundation, that support loads or that provide a weather envelope. Examples include, but are not limited to:

Complete this part of the form if one or more capital expenditures do not affect and/or benefit certain units in the residential complex. When units are listed in this section, their rental values are removed from the AGI calculation. The specific units removed from the calculation are also not given an AGI increase for the corresponding capital expenditure. If all units in the residential complex are affected by all capital expenditures, then this section must be left blank.

Complete the table:

Units that are not covered by the application can still be affected by the capital expenditures. If you indicate a unit is not covered by the application on the RUI, that unit will not be included in the order issued by the LTB. However, if the unit benefits from the capital expenditure, the rental value for that unit is still required for the AGI calculation even if the unit is not included in the application. You should not list that unit in Schedule 2: Part B of the application.

Example #1: The capital expenditure is for a new roof. If all units in the complex are located under the new roof, then all units will be affected by and benefit from the new roof. In this example, the table should be left blank to indicate that all units are affected by the roof expenditure.

Example #2: The capital expenditure is for a stove in Unit 6. Since only Unit 6 has access to the new stove, it is the only unit that can benefit from or be affected by the new stove. Therefore, all other units should be excluded from the calculation for this capital expenditure. In this example, the Landlord can indicate in Schedule 2 Part B that ‘All units except for unit 6 are to be removed.’ Alternatively, the Landlord could list all units except for unit 6 in this section.

Under subsection 126(8) of the RTA, a capital expenditure to replace a system or thing is not an eligible capital expenditure if the system or thing that was replaced did not require major repair or replacement. Exception – it is eligible if the replacement of the system or thing promotes:

Complete the chart as follows:

Shade either the "Yes" or "No" box to indicate whether you received any money from an insurer, government grants or forgivable loans or other assistance, trade-in, salvage or resale for any capital expenditure item(s). When the LTB calculates the above-guideline increase you are claiming, any amounts listed here will be deducted from the total costs identified in Schedule 2: Part A of the application.

Shade either the "Yes" or "No" box to indicate whether any of the capital expenditure items relate to non-residential portions of the complex or other residential complexes.

If you answered "Yes", you must list the item number and provide details about how you propose the costs should be allocated. You can propose to allocate the costs based on floor area, market value, or revenue generated. You can propose different methods for allocating the costs for different capital expenditure items. If none of these methods are reasonable, you may propose another method. However, at a hearing the LTB may find that a different allocation method is more appropriate.

For the method you propose, you must provide the information necessary to allocate the costs between the residential portions and non-residential portions of the complex (or other residential complexes). For example: The capital expenditure you are claiming is a new roof. Your residential building has a commercial coffee shop on the main floor. Both the residential units and the coffee shop are under the same roof. If you propose an allocation method using rental revenue, you can provide the monthly rental revenue collected for both the residential units and the coffee shop. Alternatively, you can identify the percentage of costs that should be allocated to the residential portion of the complex.

If you answered "No", then you do not have to complete the rest of Part E on the form.

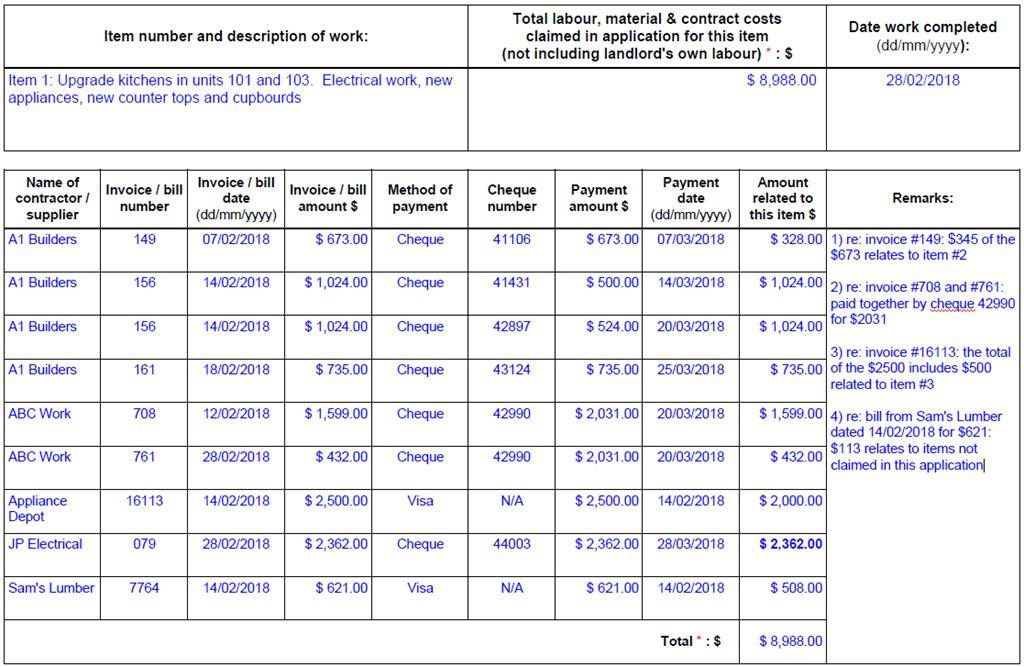

The Capital Expenditures: Additional Details (CEAD) form serves as Table of Contents for the evidence of costs and payment you will be providing in your application. The evidence of costs and payment submitted with your application should be presented in the same order as on the CEAD form. Each capital expenditure requires a separate CEAD form which lists the evidence of costs and payment specific to that item.

If you require more than one form for an item, complete additional pages of the form. At the bottom of each page, indicate the page number and the total number of pages (copies) included for the item. For example, if an item requires three pages in total, write 'Page 1 of 3' on the first page of the form. For each additional page you include for an item, write the item number at the top of the page (under Item number and description of work), and write "continued". It is not necessary to repeat the total labour, material and contract costs, or the date the work was completed.

Identify each separate capital expenditure at the top of the form. The information listed in this section must match Schedule 2: Part A of your application. Complete as follows:

Each invoice should be listed on a separate row of the table as evidence of the costs and payment incurred for the capital expenditure. Invoices from the same contractor/supplier should be listed consecutively. Complete the table to provide details about the capital expenditure work:

Contractor/supplier: In the first column, indicate the name(s) of the contractor(s) and/or supplier(s) you used for this capital expenditure.

As indicated above, you will need to allow enough rows to identify all the invoices and payments related to a contractor or supplier before you list the information for the next contractor or supplier. (See the example at the end of this section).

Invoice/bill number: In this column, list all of the invoices or bills this contractor or supplier gave you in successive rows. If you paid for a particular invoice in more than one instalment, remember to allow a row on the chart for each payment before listing the next invoice. (See the example at the end of this section.)

If you received an invoice or bill which is not numbered (for example, a bill from a retail store), indicate N/A (not applicable) in this column.

Invoice/bill amount: In this column, indicate the total amount of the invoice or bill, even if part of the invoice or bill is not related to this item.

Example: If the invoice was for $400, but $150 related to a different capital expenditure item, include $400 in this column. Use the 'Remarks' column to explain the discrepancy. (See the example at the end of this section).

Method of Payment: In this column, indicate how you paid for each invoice or bill.

Example: if you paid with your Visa Card, you could write 'Visa' in this column.

Payment amount: In this column, indicate the total amount of the payment, even if part of the payment relates to another item. Use the 'Remarks' column to explain what the payment covered, and, if a portion related to another capital expenditure item, to identify that item.

If you paid for more than one invoice or bill from a particular contractor or supplier at one time, indicate the total amount you paid in this column. For example, if you received two invoices from a particular supplier, one for $300, and one for $400, and paid for both invoices with a cheque for $700, you would include $700 in this column. Use the "Remarks" column to explain that the payment covered more than one invoice, and to identify the relevant invoices.

Amount related to this item: In this column, indicate the amount of the payment that relates specifically to this capital expenditure item.

Example: if you made a payment of $900 for a particular invoice, but $300 of that invoice applied to a different capital expenditure item, you would write $600 in this column.

Add all the amounts in this column and include the total under "Total" at the bottom of the chart. If you used more than one page for this capital expenditure item, include the total on the final page. The total you indicate in this column should be the same as the amount you included in "Total labour, material & contract costs..." at the top of the form.

Remarks: Use the Remarks column to explain anything that might not be clear on the chart itself.

Example: If an invoice included amounts unrelated to the capital expenditure item, and therefore, the invoice amount was higher than the amount related to this item, you would explain the discrepancy here.

Below is an example which illustrates how to fill out the chart in different situations:

Complete this form if you indicated in Part 3 of the form that you have been ordered to do work related to one or more elevators in the residential complex, and the work has not been completed. You must complete this form even if the compliance period for doing the work has not yet passed.

If you are filing by mail or courier, complete this form to provide the LTB with the information required to process your application. Your application will not be accepted if you do not pay the application fee at the time of filing. If you owe money to the LTB as a result of failing to pay a fee or any fine or costs set out in an order, your application may be refused or discontinued.

Shade the appropriate box to show whether you are paying by money order, certified cheque, Visa or MasterCard. If you are filing by mail or courier, you can pay by credit card by completing the Credit Card Payment Form and submitting it with your application. You cannot pay by cash or debit card if you are filing your application by mail or courier.

If you are filing your application electronically, you will be e-mailed a secure payment portal link to enter your credit card information. For security reasons, we ask that you do not include credit card information over e-mail when filing your application. The link to the payment portal will expire after three (3) calendar days. If your link expires before you have submitted your credit card information, e-mail a request for an extension to pay to AGIpayments@ontario.ca.

You must complete this form with information about each rental unit in the complex. If you are applying for Reason 3, you must also include rental units that are not covered by the application and rental units that are vacant or not rented.

Note: If you do not have access to Microsoft Excel, please email AGIUnit@ontario.ca for assistance. Please note that this support is only for those who cannot access Microsoft Excel, not for general help with filling out the form.

The first and last names of each Tenant covered by the application are required on the RUI form. If more than one Tenant resides in a unit, list each Tenant in separate rows of the RUI. The rental information for a given unit must be identical for each Tenant (for example, current rent, date the tenancy began, and whether the unit is covered or not covered by the application). If the rental unit data is different for multiple Tenants in the same unit, the above-guideline increase (AGI) capital expenditure calculation will only use the rental data for the last Tenant of the unit listed on the RUI form.

Complete the following columns in the 'Tenant Information' tab:

Example:

| Tenant First Name | Tenant Last Name | Unit/Apt/Suite | Street Number | Street Name | City | Province | Postal Code |

|---|---|---|---|---|---|---|---|

| Mary Sue | Smith | 1 | 20 | Main Street | Ottawa | Ontario | K2B 0R4 |

| Billy | Smith | 1 | 20 | Main Street | Ottawa | Ontario | K2B 0R4 |

| George | Jones | 2 | 20 | Main Street | Ottawa | Ontario | K2B 0R4 |

| Samantha | McKee | 3 | 20 | Main Street | Ottawa | Ontario | K2B 0R4 |

| Brett | Anderson | 4 | 20 | Main Street | Ottawa | Ontario | K2B 0R4 |

| 5 | 20 | Main Street | Ottawa | Ontario | K2B 0R4 | ||

| Taylor | Miller | 6 | 20 | Main Street | Ottawa | Ontario | K2B 0R4 |

| Henry | Miller | 6 | 20 | Main Street | Ottawa | Ontario | K2B 0R4 |

Example: Select 'No' in this column if you do not want the LTB to make an order for an above-guideline increase for the identified unit. Any Tenant living in units not covered will not be party to the application or included in the LTB's order.

Example: If the FED is June 1, 2024, the Landlord's deadline to file the application would be March 3, 2024 (90 days before June 1). The Landlord would fill in the date the tenancy began in this column for every rental unit where the tenancy began after September 3, 2022 (18 months before March 3, 2024).

Example: A Landlord wants to increase the rent by more than the guideline for four rental units (units 1, 2, 3 and 4) in a residential complex that has a total of six rental units. Unit 5 is vacant. Unit 6 is rented but is not covered by the application. The FED will be June 1, 2024. The landlord's deadline to file the application is March 3, 2024. The tenancy for unit 4 began on January 1, 2024. The tenancies for the other units covered by the application began before September 3, 2022 (the start of the 18 month period referred to above). The monthly rents for the units in the complex are as follows:

Unit 1: $900

Unit 2: $700

Unit 3: $800

Unit 4: $800

Unit 5: $0

Unit 6: $900

This is how the columns Unit Covered by Application to the Date Current Tenancy Began can be completed (*Note: Unit/Apt/Suite Column is displaying out of order for the purposes of this example):

| Unit/Apt/Suite | Unit Covered by Application | Current Rent | Frequency of Rent | Date Current Tenancy Began |

|---|---|---|---|---|

| 1 | Yes | $900.00 | Monthly | |

| 1 | Yes | $900.00 | Monthly | |

| 2 | Yes | $700.00 | Monthly | |

| 3 | Yes | $800.00 | Monthly | |

| 4 | Yes | $800.00 | Monthly | 01-01-2024 |

| 5 | No | $ - | Monthly | |

| 6 | Yes | $900.00 | Monthly | |

| 6 | Yes | $900.00 | Monthly |

The data entered in the RUI should be in sequential order by unit number. If your data is appearing out of order, please take the following steps to sort the data.

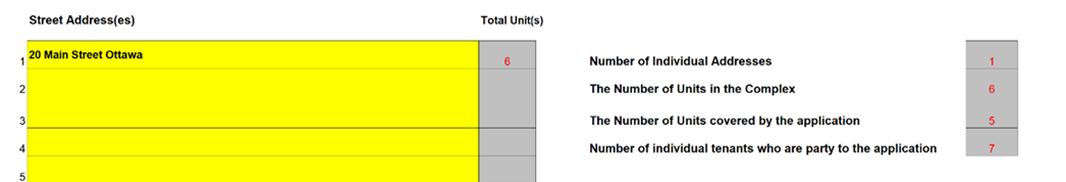

Verify your data by confirming the totals listed on the 'Summary' tab of the RUI. The totals populated on the Summary tab appear automatically.

The Total Units and Number of Units Covered by the application as listed on the Summary tab must match the values identified in Part 2 of your application.

To file this application by email, send all of your completed documents to AGIpayments@ontario.ca. Be sure to include the following in your email:

To file this application in person, by mail, or by courier, you must include the following:

Your application will be refused if any of the items listed above are missing.

You can file your application in one of the following ways:

You can submit your application materials and electronic version of the RUI form in MS Excel format by e-mail to AGIpayments@ontario.ca. In your subject line, indicate the address of the residential complex and the FED that you are claiming in your application. Do not include any credit card information in your e-mail or attached materials.

Upon submitting your application by e-mail, you will be e-mailed a secure payment portal link from AGIpayments@ontario.ca. Payment can be made by credit card through the secure LTB payment portal link. If you cannot afford the fee, you can submit a Fee Waiver Request. The payment portal link will expire after three (3) calendar days. If you require an extension of time to enter your payment information in the portal link, e-mail your request to AGIpayments@ontario.ca.

Mail or courier your L5 application and supporting documents to the nearest LTB office. To find a list of LTB mailing addresses, visit Contact - Landlord and Tenant Board. You can also call the LTB at 416- 645-8080 or 1-888-332-3234 (toll-free).

If you file your application by mail or courier, you must send the electronic MS Excel version of your RUI form by email to AGIpayments@ontario.ca as follows:

If you mail or courier your application, you can pay the application fee by certified cheque, money order, Visa or MasterCard. Certified cheques and money orders must be made payable to the Minister of Finance. If you are filing by mail or courier and paying by Visa or Mastercard, you must complete the Credit Card Payment Form and submit it with your application.

Some ServiceOntario Centres accept Landlord and Tenant Board applications in person. Please visit ServiceOntario Centres for a list of locations that accept LTB filings.

If you file your application in person, you must send the electronic MS Excel version of your RUI form by email to AGIpayments@ontario.ca. Refer to the above Mail or Courier section for more information on filing the electronic RUI.

If you file your application in person, you can pay for your application by cash, credit or debit card at the counter.

You can visit the LTB website at: tribunalsontario.ca/ltb.

You can call the LTB at 416-645-8080 from within the Toronto calling area, or toll- free at 1-888-332-3234 from outside Toronto, and speak to one of our Customer Service Officers.

For file-specific questions, you can email AGIUnit@ontario.ca. Your email subject line must include your file number.

Customer Service Officers are available Monday to Friday, except holidays, from 8:30 a.m. to 5:00 p.m. They can provide you with information about the Residential Tenancies Act and the LTB's processes; they cannot provide you with legal advice. You can also access our automated information menu at the same numbers listed above 24 hours a day, 7 days a week.