(Disponible en français)

Table of Contents

You can use this application to have the Landlord and Tenant Board (LTB) determine whether your landlord collected money from you that they should not have collected or failed to pay you money they owe you. There are eight reasons for making this application. You can file this application, if your landlord:

You can make this application if you are either a current or former tenant, however only former tenants can apply if the landlord did not give them the proceeds of the sale of their personal property (Reason 7).

If you are a prospective tenant, you can only make this application if the landlord has:

If the LTB determines that the landlord did any of the above things, the LTB can order the landlord to pay you the money they owe you.

Read these instructions before completing the application form. You are responsible for ensuring that your application is correct and complete. Follow the instructions carefully when you complete the application form.

The information you fill in on the form will be read electronically; therefore, it is important to follow the instructions below:

Fill in the complete address of the rental unit, including the unit number (or apartment or suite number) and the postal code.

If the street name includes a direction that will not fit in the five spaces provided (such as Northeast) use the following abbreviations: NE for Northeast, NW for Northwest, SE for Southeast, SW for Southwest.

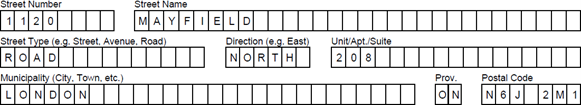

Example:

If the address is: #208 at 1120 Mayfield Road North, London, this is how you should complete Part 1 of the application:

In the Tenant Names and Address section, fill in your name. If two tenants live in the rental unit, fill in both your names. If more than two tenants live in the rental unit, fill in information about two tenants in this section of Part 1. Provide the names, addresses and telephone numbers of any additional tenants on the Schedule of Parties form which is available from the LTB website at tribunalsontario.ca/ltb.

Fill in your mailing address only if it is different from the address of the rental unit. Provide your daytime and evening telephone numbers. Also provide your fax number and e-mail address if you have them.

In the Landlord’s Name and Address section, fill in the landlord’s name and address. If the landlord is a company, fill in the name of the company under “First Name”. Include both daytime and evening telephone numbers and a fax number and e-mail address, if you know them.

If there is more than one landlord, fill in information about one of the landlords in this section of Part 1. Provide the names, addresses and telephone numbers of any additional landlords on the Schedule of Parties form which is available from the LTB website at tribunalsontario.ca/ltb.

In the Other parties to the Application, shade the appropriate circle to indicate whether you are also applying against your superintendent or landlord’s agent because they caused the problem.

If you answered “Yes”, complete the Schedule of Parties form and attach it to your application. The Schedule of Parties form is available from the LTB website at tribunalsontario.ca/ltb.

If you or your landlord have filed other applications that relate to this rental unit, and those applications have not been resolved, fill in the file numbers in the space provided.

Shade the appropriate box or boxes to indicate what reasons you are applying for. There are many different reasons for making this application, so read these instructions carefully and choose only the reasons that apply to your situation.

Note: The most the LTB can order based on your claim is $50,000. If you believe the landlord owes you more than $50,000, and you want to collect the full amount, you should apply to court and not to the LTB. Once the LTB issues an order based on your application, you no longer have any claim to amounts greater than $50,000 from your landlord.

Reason 1: My landlord charged me an illegal rent, which I have paid

Shade this box if you are applying because you believe your landlord has charged you a higher rent in the last 12 months than the law allows. If the reason you believe your landlord charged you an illegal rent is because they did not give you the required information to tell you about an Order Prohibiting a Rent Increase (OPRI) affecting your unit, then do not shade this box – shade box 8 instead.

Then, fill in the total amount of rent that you believe the landlord overcharged you in the last 12 months of your tenancy.

Here is an example of how to calculate the amount you were overcharged in the last 12 months:

Example:

Timothy Irwin paid $800 rent per month from December 1, 2014 to January 31, 2015. On January 15, 2015, the landlord gave him a notice that his rent would increase to $820.80 on February 1, 2015. He paid this rent from February to November. However, because he did not receive a proper 90 day notice for the rent increase and the amount was higher than the rent control guideline, Timothy believes he should have been charged $800 per month for this period. On November 18, 2015, he filed an application with the LTB. Here is how he determined the amount he believes he was overcharged:

Total rent paid:

Dec - January (2 months): $800 x 2 = $1600

Feb - Nov (10 months): $820.80 x 10 = $8208

Total = $9808

Total rent that should have been paid:

$800 x 12 months = $9600

Total = $9600

Amount overcharged:

$9808 - $9600 = $208

Timothy indicated on the form that he should be rebated $208.

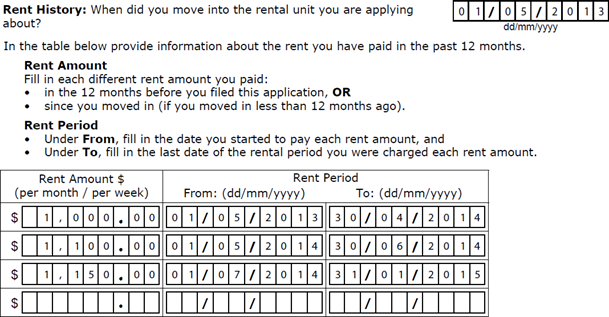

Rent History

You must provide a rent history for the past year, or, if you have lived in the rental unit for less than one year, you must provide a rent history from the date you moved into the rental unit to the present.

Fill in the date you moved into the rental unit in the space provided, and then complete the table as follows:

Example:

Allen Wong is making an application on January 15, 2015 for a rebate. He moved into the rental unit on May 1, 2013. At that time, he paid a rent of $1000 per month. On January 15, 2014 he was still paying $1000 per month. On May 1, 2014 his rent was increased to $1100 per month. On July 1, 2014, his rent was increased to $1150 per month. Here is how he would fill out the Rent History information:

Shade the appropriate circle to indicate whether you pay rent by the month, week or other. If you choose “other”, fill in the frequency of rent payments (for example, bi- weekly) in the space provided.

Explaining your Reasons

Explain why you believe the amount you paid was more than the lawful rent.

Reason 2: I paid an illegal charge to my landlord, my landlord’s agent or the superintendent

Shade this box if you are applying because you believe you paid an illegal charge to your landlord, landlord’s agent or the superintendent. Some examples of illegal charges are: key money, premiums, fees, bonuses, commissions or penalties (whether or not they are refundable), etc.

If the landlord required you to pay the landlord’s reasonable costs to have replacement keys made for you when you lost your keys, this is not an illegal charge. However, the landlord cannot charge you for replacement keys if the landlord decided to change the locks.

You can only apply for illegal charges you paid in the last 12 months. If you have paid more than one illegal charge, provide this information for each charge.

On the form, fill in what the payment was for, the date you made the payment, the name and title of the person you made the payment to, and the amount of the payment.

Explaining your Reasons

Describe the circumstances under which the landlord required you to pay the illegal charge and explain why you believe the charge was illegal.

Reason 3: The landlord did not use my last month’s rent deposit to pay for the last rental period of the tenancy and did not return the deposit to me

Shade this box if you are applying because you moved out of the rental unit and the landlord did not use the last month’s rent deposit for the last rental period and did not return it to you. Fill in the date you moved out and indicate the amount the landlord is holding as a rent deposit in the space provided. You must apply within 12 months of the date the landlord retained the money illegally.

Explaining your Reasons

Explain how you calculated the amount you believe the landlord owes you, and indicate the date the landlord should have returned this money to you.

Reason 4: I entered into a tenancy agreement with the landlord but the landlord did not allow me to move into the rental unit and did not return the money paid as a deposit.

Shade this box if you are applying because the landlord did not allow you to move into the rental unit and did not return the money you paid as a rent deposit. Under the Residential Tenancies Act, 2006, a landlord is required to repay the amount they collected if they do not allow the prospective tenant to move in. In the space provided on the form, fill in the date you were supposed to move into the rental unit and indicate the total amount of money the landlord is holding. You must apply within 12 months of the date the landlord retained the money illegally.

Explaining your Reasons

Describe the circumstances under which you paid the rent deposit and the circumstances under which the landlord refused to allow you to move into the rental unit.

Exception:

If the landlord collects a deposit from a prospective tenant for a specific unit, and before the prospective tenant moves in, they agree to rent a different unit from the landlord, the landlord can apply the deposit to the second unit. In this case, the landlord would only be required to repay the difference, if any, between the amount collected as a deposit for the first unit and the amount that the landlord is permitted to collect as a deposit for the second unit.

Reason 5: The landlord owes me interest on the last month’s rent deposit

Shade this box if you are applying because the landlord did not pay you the interest on the rent deposit. Fill in the amount of interest on the rent deposit that your landlord owes you in the space provided.

The landlord is required by law to pay the tenant interest each year on the last month’s rent deposit. Under the Residential Tenancies Act, 2006 the interest rate is equal to the guideline rate that is in effect at the time the interest payment becomes due.

Example:

A tenant paid $1000 as a last month’s rent deposit for their rental unit on August 1, 2013. On July 31, 2014, the landlord gives the tenant a cheque for $8.00 for one year’s worth of interest.

In this case, the landlord is required to make the interest payment to the tenant in 2014. For this reason, the landlord uses the 2014 guideline rate of 0.8%, because this is the rate that is in effect when the interest payment is due and must be paid to the tenant.

This is how the landlord calculated the amount of interest that was owed to the tenant: $1000 X 0.8% = $8.00

If the tenant stays in the unit and the landlord holds the tenant’s $1000 last month’s rent deposit for another year, the next interest payment is due on July 31, 2015. In this case, the landlord uses the 2015 guideline rate of 1.6% to calculate the interest owing for the next one year period, because the interest payment becomes due in 2015.

Explaining your Reasons

Show how you calculated the amount you believe the landlord owes you. Indicate the date the landlord should have paid this money to you.

Reason 6: The landlord gave me one of the following notices to end my tenancy and did not pay me compensation by the termination date on the notice:

If the landlord gave the tenant a Form N12 notice because the landlord, a family member or someone providing care to the landlord or family member requires the rental unit, then the landlord must pay the tenant compensation in an amount equal to one month’s rent or find the tenant another rental unit acceptable to the tenant.

If on or after July 21, 2020, the landlord gave the tenant a Form N12 notice because a purchaser or a family member of the purchaser requires the rental unit, then the landlord must pay the tenant compensation in an amount equal to one month’s rent or find the tenant another rental unit acceptable to the tenant.

If the landlord has given a Notice to End Your Tenancy Because the Landlord wants to Demolish the Rental Unit, Repair it or Convert it to Another Use and there are five or more residential units in the complex, then the landlord must pay the tenant compensation equal to three months' rent or find the tenant another rental unit acceptable to the tenant.

If on or after July 21, 2020, the landlord has given a Notice to End Your Tenancy Because the Landlord wants to Demolish the Rental Unit, Repair it or Convert it to Another Use and there are fewer than five residential units in the complex, then the landlord must pay the tenant compensation equal to one month's rent or find the tenant another rental unit acceptable to the tenant.

Exceptions:

Landlords are not required to pay compensation to tenants if they were ordered to do the work (for example, by the municipality).

If the landlord has given the notice because the landlord intends to repair or renovate the rental unit, and the tenant has given written notice that they intend to move back in when the work is done, the landlord is required to pay the tenant compensation:

Shade the box on the form if the landlord should have paid you compensation. Fill in the amount of compensation you believe the landlord owes you in the space provided. You can only apply if the landlord should have paid you the compensation in the last 12 months.

Explaining your Reasons

Show how you calculated the amount you believe the landlord owes you and indicate the date you moved out of the rental unit as a result of the notice.

Reason 7: The landlord sold my personal property and did not pay me the proceeds from the sale

Under the Residential Tenancies Act, 2006 (RTA) the landlord can sell the tenant’s property in the following cases.

Abandoned Property:

The landlord is allowed to sell any property left behind when a tenant abandons a rental unit. The landlord must either obtain an order from the LTB terminating the tenancy, or give the tenant and the LTB a notice of the landlord’s intent to dispose of the property before selling it. If the landlord sold the property, the tenant has six months from the date of the order or the date the landlord gave the notice to request the proceeds from the sale. The landlord is allowed to deduct any arrears of rent that the tenant owes the landlord and a reasonable amount for out of pocket expenses the landlord incurred to store or sell the tenant’s property.

Tenant’s Death:

If a tenant of a rental unit dies and there are no other tenants of the rental unit, the tenancy is automatically terminated 30 days after the tenant’s death. The 30-day period does not have to end at the end of a rental period. After the tenancy is terminated, the landlord is allowed to sell any property left behind that has not been claimed by the tenant’s estate. If the landlord sold the property, the representatives of the tenant’s estate or a member of the tenant’s family (if a representative has not been appointed) have six months from the date the tenant died to claim the proceeds from the sale on behalf of the estate. The landlord is allowed to deduct any arrears of rent that the estate owes the landlord and a reasonable amount for out of pocket expenses the landlord incurred to store or sell the tenant’s property.

Shade the box on the form if you are applying because the landlord did not pay you the proceeds of the sale of your property, or if you are the representative of the estate of a deceased tenant or a family member (if a representative has not been appointed) and you are applying because the landlord did not pay the estate the proceeds of the sale of the tenant’s property. Fill in the amount you believe the landlord owes you for the sale of your property in the space provided. You can only apply if the landlord should have paid the money in the last 12 months.

Explaining your Reasons

Show how you calculated the amount you believe the landlord owes you and indicate the date the landlord should have paid it to you.

Reason 8: The landlord did not give me the required notice telling me that there was an Order Prohibiting a Rent Increase affecting my rental unit

Under the RTA if a tenant files a maintenance application and the LTB determines that there are serious maintenance problems that affect the rental unit, the LTB can issue an Order Prohibiting a Rent Increase (OPRI).

If you are a prospective tenant, and there is an OPRI on the unit you want to rent, the landlord must give you a notice called a Landlord’s Notice to a New Tenant about an Order Prohibiting a Rent Increase before you enter into the agreement. This notice gives you information about the OPRI and is available from the LTB’s website at tribunalsontario.ca/ltb. If you have already agreed to rent the unit and then an OPRI is issued that affects your unit, the landlord must also give you the notice about the OPRI as soon as they get a copy of it.

If you are applying for this reason, you can ask the LTB for the following remedies:

Shade the box or boxes completely next to your answer.

If you are the tenant, shade either the circle marked “Tenant 1” or “Tenant 2” depending on whether you filled in your name under “Tenant 1” or “Tenant 2” on page 1 of the form. Then, sign the application form and fill in the date.

If you are the tenant’s representative, shade the circle marked “Tenant’s Representative”. Then, sign the application form and fill in the date.

The LTB wants to ensure that everyone who uses its services can ask for and receive accommodation and/or French Language services in order to be able to participate in its proceedings on an equal basis.

Shade the appropriate box or boxes on the form to indicate whether you need accommodation under the Ontario Human Rights Code, French-language services or both. The LTB will not include a copy of this form when we give the other parties a copy of the application form. However, the information will be included in your application file. The file may be viewed by other parties to the application.

If you require accommodation under the Human Rights Code, explain what services you need in the space provided.

Complete this form to provide the LTB with the information required to process your application. Your application will not be accepted if you do not pay the application fee at the time you file the application. If you owe money to the LTB as a result of failing to pay a fee or any fine or costs set out in an order, your application may be refused or discontinued.

You may request a fee waiver if you meet the financial eligibility requirements set out by the LTB. You will need to complete the Fee Waiver Form which is available from the LTB website at tribunalsontario.ca/ltb. For more information about fee waivers and the eligibility criteria, go to the fee waiver rules and practice direction on the Rules of Practice page of LTB website.

Shade the appropriate box to show whether you are paying by money order, certified cheque, Visa or MasterCard. If you file using the Tribunals Ontario Portal, you can file and pay directly on the system using a debit or credit card. Do not upload credit card information on documents if you are using the Tribunals Ontario Portal.

If you are filing my mail or courier, you can pay by credit card by completing the Credit Card Payment Form and submitting it with your application. You cannot pay by cash or debit card if you are filing your application by mail or courier.

To file this application, you must include the following:

Your application will be refused if any of the items listed above are missing.

You can file your application in one of the following ways:

Complete and pay your T1 application online using Tribunals Ontario Portal.

If you use the Tribunals Ontario Portal, you must pay by credit card or debit card through the portal and don’t need to complete a separate credit card payment form.

Mail or courier your T1 application to the nearest LTB office.

To find a list of LTB office locations visit the LTB website at tribunalsontario.ca/ltb. You can also call the LTB at 416-645-8080 or 1-888-332-3234 (toll-free).

If you mail or courier your application, you can pay the application fee by certified cheque, money order, Visa or MasterCard. Certified cheques and money orders must be made payable to the Minister of Finance. If you are filing by mail or courier and paying by Visa or Mastercard, you must complete the Credit Card Payment Form and submit it with your application.

Effective December 31, 2021, the LTB has decommissioned its fax machines assigned to regional offices. This means that except for a limited number of circumstances, the LTB no longer accepts documents, including applications, by fax.

If you must use fax to file applications or submit documents urgently because you don't have access to a computer and/or internet or can't visit a local ServiceOntario office, applicants can fax applications and documents that don't have a fee associated, or where they are eligible for a fee waiver, to 1-833-610-2242 or (416) 326-6455.

Due to Payment Card Industry (PCI) security compliance requirements, the LTB cannot accept credit card payment via fax. Applications with credit card information will be automatically deleted and not processed. Please contact the LTB at 1-888- 332-3234 for information on how to submit payment information.

You can visit the LTB website at: tribunalsontario.ca/ltb.

You can call the LTB at 416-645-8080 from within the Toronto calling area, or toll- free at 1-888-332-3234 from outside Toronto, and speak to one of our Customer Service Officers.

Customer Service Officers are available Monday to Friday, except holidays, from 8:30 a.m. to 5:00 p.m. They can provide you with information about the Residential Tenancies Act and the LTB's processes; they cannot provide you with legal advice. You can also access our automated information menu at the same numbers listed above 24 hours a day, 7 days a week.